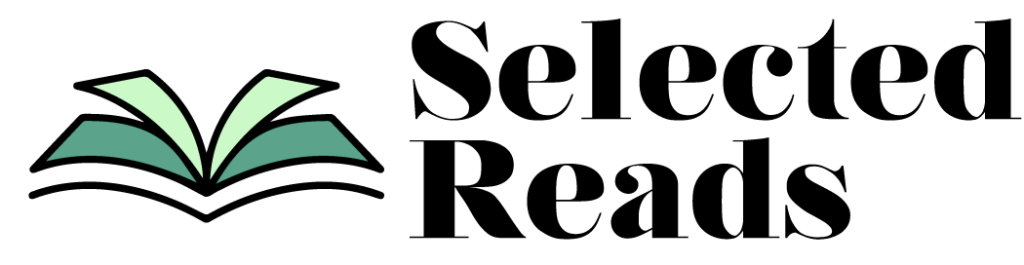

In “The Total Money Makeover,” America’s trusted financial coach Dave Ramsey provides a no-nonsense guide for turning your financial life around. Forget about the quick-rich schemes and the financial jargon that leaves you more confused than when you started. Dave’s approach is straightforward and based on practical steps that lead to proven results.

The book begins by emphasizing the importance of ditching debt, describing it as the greatest obstacle to financial freedom. Ramsey doesn’t just tell you to pay off your debts; he provides a structured plan to get you there, even going as far as helping you list them from the smallest to largest and tackle them one by one. Yes, this includes all kinds of debt—from your car loan to your mortgage. The goal? To get you to a point where you owe nothing to anyone, liberating your income to grow your wealth.

One of the book’s standout features is Ramsey’s ability to debunk “the 10 most dangerous money myths,” which range from buying a house as an investment to relying on Social Security for retirement. He cuts through these myths with razor-sharp logic, using examples and statistics to prove his point. These myths are the pitfalls that derail many from achieving financial peace, so having them debunked is invaluable.

But it’s not just about what not to do; Ramsey provides actionable advice on what you should be doing to build a “big, fat nest egg for emergencies and retirement.” He introduces the concept of the emergency fund, which isn’t just a nice-to-have, but a necessity in Ramsey’s financial plan. Having a financial cushion can be the difference between spiraling back into debt and staying on the path to wealth when life throws you curveballs.

In addition to the emergency fund, Ramsey dives deep into the importance of investing for retirement. Rather than giving a broad, general advice, he provides specifics about what types of investment vehicles to consider and what pitfalls to avoid, always emphasizing the power of compound interest.

The book includes expanded “Dave Rants,” sidebars that offer additional insights into common financial conflicts in marriage, college debt, and more. These rants bring in Dave’s personal experiences and opinions, making the financial advice relatable and digestible. Plus, the new back-of-the-book resources and forms make it easier to turn the Total Money Makeover plan into a reality.

From my own experience, I can say that the real value in this book comes from its actionable steps. Reading it feels like undergoing an actual makeover, but for your finances. You finish it with not just knowledge but a plan—a clear set of actions that, if followed, will put you on the path to financial freedom.

So, if you’re looking for more than just financial tips—if you’re looking for a comprehensive plan to overhaul your money habits—then “The Total Money Makeover: Classic Edition” is the book to read. It doesn’t offer a magic pill but provides a proven formula for financial success, built on the cornerstone of personal accountability and disciplined spending. Ramsey’s plan may be simple, but it’s definitely not easy; however, for those willing to put in the work, the financial and even emotional rewards can be immense.

Related: Best Dave Ramsey Books

The Total Money Makeover Book Club Questions

Discussing “The Total Money Makeover” can bring about some really interesting conversations on personal finance, debt, and financial freedom. Here are some book club questions tailored to stimulate discussion:

- How did Dave Ramsey’s approach to debt resonate with you? Do you agree that debt should be avoided at all costs?

- Ramsey emphasizes creating an “emergency fund.” How did this concept impact your view on savings? Do you already have one, and if not, are you considering starting one?

- The book debunks “the 10 most dangerous money myths.” Which of these myths had you believed, and how has Ramsey’s explanation changed your perspective?

- The concept of the “debt snowball” is a cornerstone of Ramsey’s plan. How practical do you think this approach is? Have you tried it or would you consider trying it?

- The book includes expanded “Dave Rants” that delve into issues like marriage conflict and college debt. Which rant did you find most helpful or relatable, and why?

- What are your thoughts on Ramsey’s investment advice, particularly his views on retirement savings and the types of investment vehicles one should consider?

- How feasible do you think it is to follow Dave Ramsey’s steps strictly? What challenges do you anticipate in sticking to the plan?

- What are your thoughts on the book’s overall tone? Did the motivational language inspire you, or did it feel like too much at times?

- Did you make use of the back-of-the-book resources and forms? Do you think they added value to the book?

- After reading the book, are there specific habits or beliefs about money that you are planning to change? What steps have you taken or are planning to take?

- Dave Ramsey often brings spirituality and personal ethics into his financial advice. How did this blend of spirituality and finance sit with you?

- Has reading this book made you more optimistic or pessimistic about your financial future? Why?

- Ramsey discourages the use of credit cards entirely. What are your thoughts on this? Is it a realistic suggestion in today’s society?

- What did you think of the case studies and testimonials included in the book? Did they inspire you or make the advice feel more tangible?

- How would you rate the book’s readability and structure? Was it easy to follow, and did the progression make sense to you?

From my perspective as an educator, I find that discussing books like this can be a real eye-opener for people at various stages of their financial journey. Ramsey’s strong opinions are sure to spark some lively debates, and you can learn a lot from each other’s perspectives. Happy discussing!

Final thoughts

I like to reiterate at the end of this book summary that what I really appreciate about Ramsey’s book is how it cuts through the noise and delivers a simple, actionable plan. It dispels the myths around money that we often cling to—like the idea that debt is just a part of life—and challenges us to live differently.

In my own experience, talking money is often taboo, especially in educational settings where we’re more focused on imparting knowledge than financial literacy. However, this book can serve as a valuable resource for anyone willing to take their financial health seriously. It may not have the nuances of a personalized financial plan, but it’s a great starting point.

The book’s tone, peppered with “Dave Rants,” brings an emotional component to what can typically be a dry subject. It adds personality to the text, and it reminds me a bit of how educators use real-world applications or stories to make lessons more engaging.

However, a few caveats are in order. While the steps are straightforward, following them can be anything but easy. Discipline, sacrifice, and a complete change in lifestyle are often required, and not everyone is in a position to make those changes immediately. And let’s not forget, the book is rooted in American financial systems, so some advice may not be as applicable to those dealing with other economic frameworks.

Despite these reservations, the Total Money Make Over has merits that make it worthy of discussion, especially in a group setting. Ramsey’s passion for helping people gain financial freedom is contagious, even if you don’t agree with all his methods or philosophies.