Navigating the world of personal finance can feel like a complex labyrinth. However, understanding money doesn’t need to be a challenging ordeal. Whether you’re looking to become debt-free, save for retirement, or simply manage your finances better, the right personal finance book can pave the way.

This post provides a list of some of the best personal finance books available. From timeless classics to recent bestsellers, these books offer invaluable insights into everything from budgeting and investing to achieving financial independence and wealth accumulation.

[Related: Best Financial Literacy Books for Kids]

Packed with practical advice, personal anecdotes, and actionable tips, these books can transform your financial mindset and set you on the path to financial success. So whether you’re a financial novice or just looking for new strategies to grow your wealth, these books have got you covered.

Personal Finance Books

Here are our top picks for personal finance books:

1. Rich Dad Poor Dad, by Robert T. Kiyosaki

“Rich Dad Poor Dad” by Robert T. Kiyosaki is a groundbreaking finance book that flips conventional wisdom on its head. Kiyosaki introduces two dads: one rich, one poor, and illustrates how each shaped his thoughts about money and investing.

The book challenges the way people think about employment, assets, and wealth creation. It is filled with parables and advice on how to escape the ‘rat race’ and attain financial independence.

2.The Psychology of Mone, by Morgan Housel

“The Psychology of Money” by Morgan Housel takes a fresh approach to money matters. It emphasizes that good money management is not about financial wisdom but behavior. It provides insight into how emotions, pride, and personal beliefs can impact financial decisions, stressing that understanding one’s own behavior is key to mastering money. It’s filled with enlightening stories about how different people view wealth, and it offers actionable advice on making better financial decisions.

3.How to Manage Your Money When You Don’t Have Any, by Mr Erik Wecks

Erik Wecks’ “How to Manage Your Money When You Don’t Have Any” is a brutally honest guide that offers pragmatic advice for people facing financial challenges.

Rather than emphasizing wealth creation, the book focuses on practical skills like budgeting, avoiding predatory loans, and understanding consumer rights. It is an invaluable resource for those striving to live a debt-free life.

4.Get Good with Money, by Tiffany the Budgetnista Aliche

Tiffany Aliche’s “Get Good with Money” aims to help you become ‘financially whole’. It breaks down the complex world of personal finance into ten comprehensive steps that cover everything from budgeting, saving, investing to creating a plan for emergencies and retirement. The book aims to demystify personal finance and provide practical, actionable advice for achieving financial well-being.

5.How to Stop Living Paycheck to Paycheck, by Avery Breyer

Avery Breyer’s “How to Stop Living Paycheck to Paycheck” is a proven, simple guide to help you regain control of your finances and stop the paycheck-to-paycheck lifestyle. The book is designed to be digestible, actionable, and effective, turning your personal finance from a source of stress to a source of security.

6.Money Honey: A Simple 7-Step Guide for Getting Your Financial $hit Together, by Rachel Richards

In “Money Honey,” Rachel Richards provides a simple yet effective seven-step guide to take control of your finances. This book stands out with its humorous and relatable tone, making personal finance engaging and less daunting.

Rachel shares the exact strategies she used to achieve financial independence at a young age, offering hope and a clear path forward to readers.

7.The Simple Path to Wealth, by J L Collins

“The Simple Path to Wealth” by J L Collins offers an easy-to-follow strategy for achieving financial independence. The book’s premise is that keeping your investments simple and automatic can lead to long-term wealth accumulation. It provides practical advice and examples, demonstrating that you don’t need a finance degree to achieve financial freedom.

8.Think and Grow Rich, by Napoleon Hill

Napoleon Hill’s “Think and Grow Rich” is a classic in personal development and self-help. Hill explores the philosophical depth of money-making secrets, emphasizing the role of thoughts and mindset in achieving financial success.

The book is built on the premise that a desire for wealth, followed by faith, knowledge, and persistence, leads to accumulation of riches.

9.Financial Freedom: A Proven Path to All the Money You Will Ever Need, by Grant Sabatier

“Financial Freedom” by Grant Sabatier emphasizes that time, not money, is our most valuable asset. The book offers a comprehensive framework for achieving financial independence quickly so that readers can live life on their own terms. It’s filled with practical advice on how to save more, make more money, and invest wisely.

10.The Infographic Guide to Personal Finance, by Michele Cagan CPA, Elisabeth Lariviere

“The Infographic Guide to Personal Finance” by Michele Cagan CPA and Elisabeth Lariviere takes a visual approach to personal finance, making it fun and accessible. It covers everything from budgeting, saving, and paying off debt to buying a house and preparing for retirement. This visual guide simplifies complicated financial concepts, making them easier to understand and apply.

11.Debt-Free Forever: Take Control of Your Money and Your Life, by Gail Vaz-Oxlade

Debt-Free Forever: Take Control of Your Money and Your Life,” by Gail Vaz-Oxlade provides a step-by-step guide to getting out of debt and staying that way. With an in-depth understanding of how debt accumulates and affects people’s lives, Vaz-Oxlade offers practical tips to identify spending habits, create a realistic budget, and pay down debt. This book is not just about financial management, but a transformative journey towards regaining control of your life.

12.Personal Finance 101, by Alfred Mill

“Personal Finance 101: From Saving and Investing to Taxes and Loans, an Essential Primer on Personal Finance” by Alfred Mill offers a comprehensive introduction to managing personal finances.

This guide covers key aspects of personal finance, from saving and investing to understanding taxes and loans. It’s an excellent resource for anyone looking to develop a solid foundation in personal finance, providing a detailed yet accessible breakdown of complex financial concepts and strategies.

13.Budgeting 101, by Michele Cagan

“Budgeting 101” by Michele Cagan offers a practical guide to understanding and improving your budget. It takes readers through the steps of getting out of debt, tracking expenses, setting financial goals, and building savings.

This resource is packed with interactive quizzes, worksheets, and charts, making the budgeting process more manageable and engaging. It’s perfect for anyone seeking control over their finances and a more secure financial future.

14.The Millionaire Next Door, by Thomas J. Stanley, William D. Danko

“The Millionaire Next Door: The Surprising Secrets of America’s Wealthy” by Thomas J. Stanley and William D. Danko offers an insightful look into the lives and habits of America’s wealthy.

Based on extensive research, this book uncovers the surprising truth that many millionaires live modestly and accumulate wealth over time through hard work, prudent investing, and frugal living. This book challenges common assumptions about wealth and provides valuable lessons in financial discipline and wealth accumulation.

15.Personal Finance For Dummies, by Eric Tyson

“Personal Finance For Dummies” by Eric Tyson is a comprehensive guide designed to help readers take control of their personal finances.

The book covers everything from budgeting and saving, planning for retirement, investing in stocks and real estate, managing loans and mortgages, and understanding taxes. Its straightforward and friendly style simplifies complex financial concepts, making personal finance manageable and understandable.

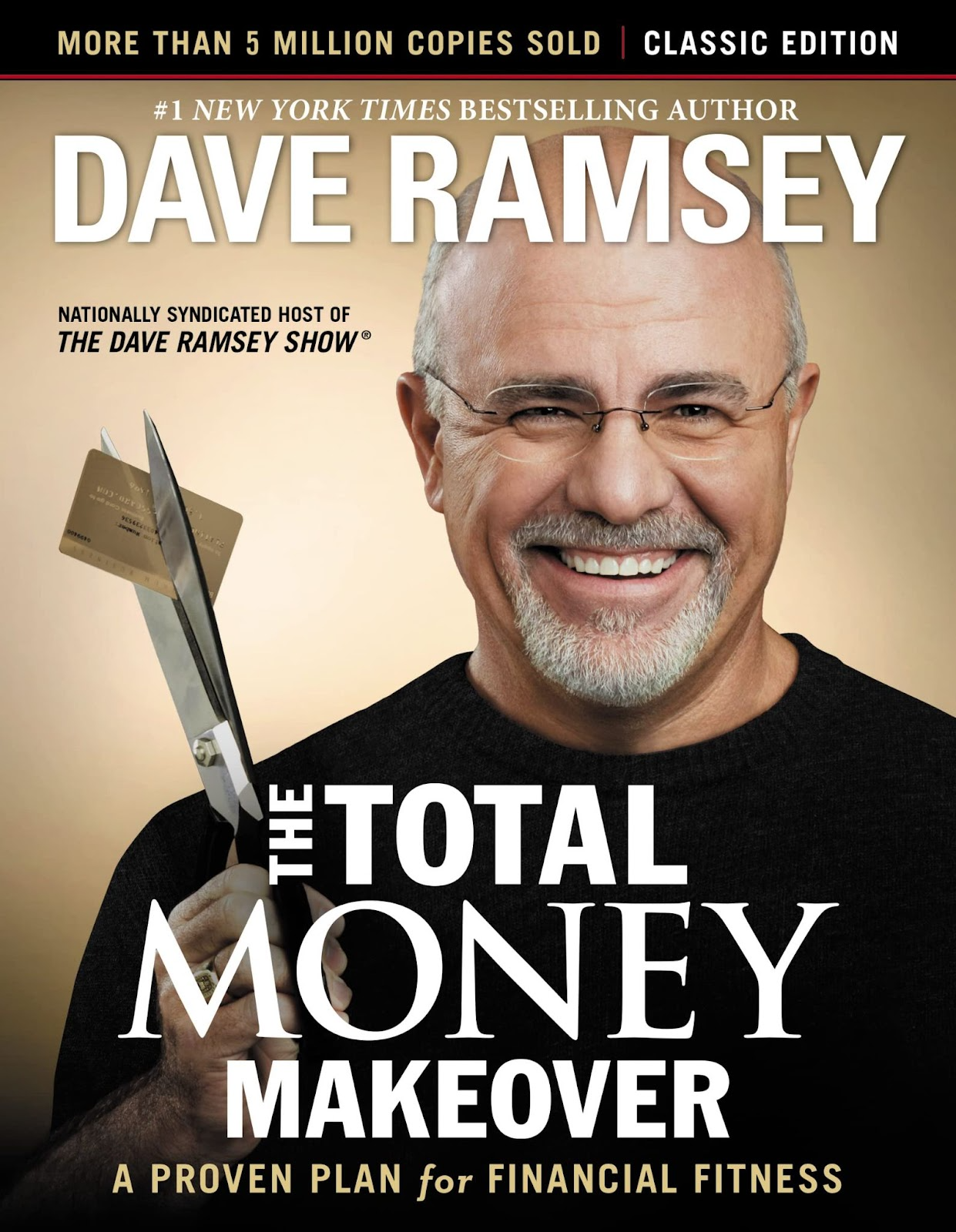

16. The Total Money Makeover, by Dave Ramsey

“The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness” by Dave Ramsey offers a practical, straightforward plan for breaking the cycle of paycheck-to-paycheck living.

Ramsey presents his seven “Baby Steps” to financial fitness, including paying off debt, saving for emergencies, and investing for the future. Ramsey’s advice is direct and tough, but it’s a proven plan that’s helped millions achieve financial health.

Final thoughts

Just as there are various teaching methods and educational technologies to meet different learning needs, the world of personal finance literature has something for everyone. From the psychologically insightful takes of Morgan Housel to the blunt, actionable advice of Dave Ramsey, these books run the gamut of styles and approaches.

What ties them together is their collective goal: to empower you to take control of your financial future. If there’s one thing I’ve learned in my journey both as an educator and a lifelong learner, it’s that knowledge is power. And in the realm of personal finance, knowledge is not just power—it’s financial freedom.